Cornwall Group’s Chairman Mark Mitchell argues that you will weather what will probably be a difficult year if you’ve invested.

Mark Mitchell, Company Chairman

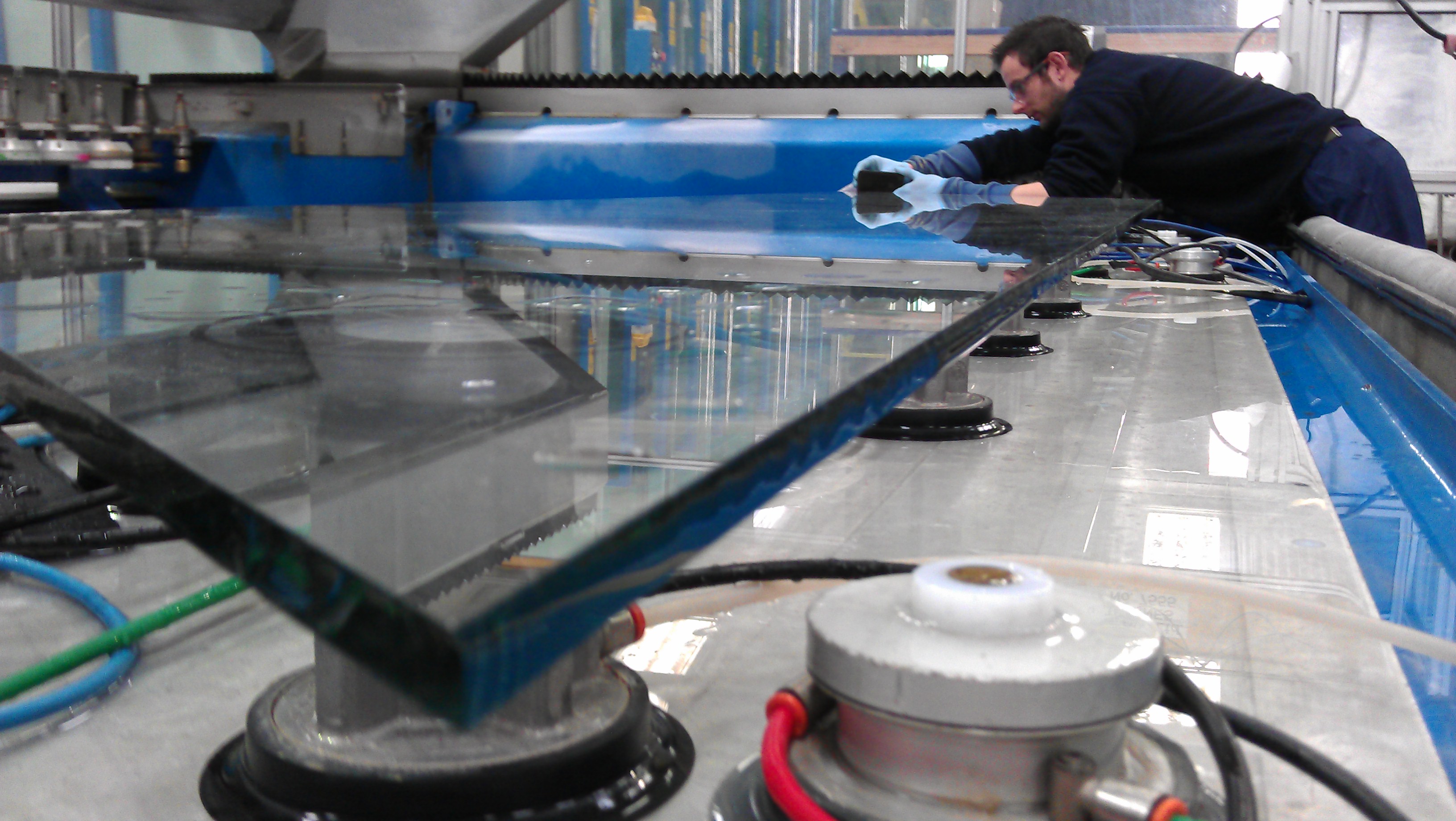

Cornwall Group – which includes Cornwall Glass Manufacturing, Mackenzie Glass, Cornwall Glass & Glazing, and the recently acquired Birmingham-based Forward Glass – has its eyes set on a profitable year, even though the challenges facing our industry are significant.

“If you look at the commercial sector – which is the source of a lot of work for companies like Cornwall Group, and indeed many glass companies in the UK – many short-term investment decisions have been put on hold,” Mark Mitchell says. “Which means many project starts have been delayed.

“One significant challenge for us all is the rate of inflation, which we hope will level off and perhaps settle at 3% or 4% before Christmas. The same goes for the cost of borrowing and interest rates, which we hope will follow a similar path to that of inflation.

“Right now, they are barriers to short-term investment, and as a result, we are anticipating a challenging year.”

Despite this, Mark expects our Group to maintain a turnover similar to what we posted in 2023, even if other factors will contribute to an overall level of uncertainty and instability.

“I’m sure other glass companies are experiencing what we are experiencing, which is lower-than-projected order levels, and glass prices dropping,” he says.

“There is a lot of glass stacking up, and that means that the prices have softened. It would be a sad day if we see one of the float tanks in the UK being mothballed or taken offline, but currently it is hard to justify the three glass manufacturing plants that are in the UK currently.

“And that’s concerning, because it’s not sustainable and we need healthy competition.”

But the situation would be much more worrying if you were a company dealing with problems as they occurred, and didn’t have a five-to-ten-year plan in place, according to Mark.

The decision to acquire Forward Glass, for example, was made months ago, and it fits Cornwall Group’s medium to long-term strategy. Furthermore, we are already committed to buy new plant and machinery at the Birmingham site, and will be introducing an apprenticeship programme.

“This will make us stronger for when the market improves in a year to 18 months’ time,” Mark says.

This is a strategy that we are already following across our other sites. Recent investment across Cornwall, Devon and Somerset include: a new sealed unit line, a new heat soak oven, a new cutting table, and new vehicles, to name just a few.

“If you order a new toughener, then it will take a year to arrive, and a new purpose-built lorry will take at least nine months,” Mark explains. “So, you’ve got to be one step ahead.

“If you don’t constantly invest in your business, then when the market picks up again in 2025 – when we expect to see a return to normalised trading – then you won’t be prepared to make the most of those opportunities.”

Mark admits Cornwall Group is in a stronger position than many other glass companies of a similar size, because of the way we are structured.

“We are still family owned, and we plough all our profits back into the company,” Mark says. “This is why we own all the buildings we operate from, and why many colleagues stay with us for most of their careers – from apprentice to MD in some cases.

“For those companies that are owned by private equity firms, often there isn’t the same long-term commitment. If the short-term growth isn’t forthcoming, there may be some awkward conversations at board level.

“Yes, 2024 will be a bumpy year for most of us, but if you can keep one step ahead of your requirements, then you’ll be ready for a more positive 2025.”

For more information, please call 01726 66325 email info@cornwallglass.co.uk or log on at www.cornwallglass.co.uk .